Rich Dad Poor Dad Summary & Review [Jan 2024]

Rich Dad, Poor Dad” by Robert Kiyosaki is a book that contrasts the financial attitudes of two father figures: his own father (“Poor Dad”) who advocates for traditional financial security through education and a steady job, and his best friend’s father (“Rich Dad”) who stresses financial education, entrepreneurship, and investing. The book is structured as a series of lessons.

My personal take on Rich dad poor dad

I read the book in my late teens and was blown away by it instantly. The ‘poor dad’ that Kiyosaki describes was the only kind of dads I had seen growing up. I was obviously getting prepared for a life where I finish college and try and get a stable/secure job – but something inside me didn’t completely agree to the model.

I had started network marketing by accident at this point – I was doomed for failure which I didn’t know at the time. But what I came with is an educational program that changed my life.

I strongly recommend the book. It is a MUST read if you ask me!

Disclosure: This site is user supported. Some of the links in this article may be affiliate links, which can help me buy a coffee or two at no extra cost to you if you decide to purchase a paid plan.

Rich Dad Poor Dad Summary

You can get Blinkist to give you professionally made summaries of over 6500+ titles. Check out Blinkist for FREE or a Massive discount.

Chapter 1: Rich Dad, Poor Dad

In this chapter, Kiyosaki introduces the foundational concept of the book: the contrasting financial philosophies of his two dads. His biological father, whom he calls “Poor Dad,” is well-educated and holds a stable job, but struggles financially. He represents conventional wisdom: the belief in the safety of a job, the importance of good grades, and saving money.

In contrast, his best friend’s father, “Rich Dad,” lacks a formal education but possesses a wealth of financial savvy. “Rich Dad” advocates for financial independence through entrepreneurship and investment. Kiyosaki notes how these contrasting viewpoints shaped his understanding of money and wealth.

He delves into the mindset that often holds people back financially and begins to outline the paradigm shift required for financial success. The emphasis is on the power of financial education and making money work for you, rather than working for money.

Chapter 2: The Rich Don’t Work for Money

This chapter focuses on the concept of financial independence and escaping the “rat race.” Kiyosaki describes his early experiences working for his “Rich Dad” and learning that the rich don’t simply work for money.

Instead, they focus on acquiring assets that generate income. He discusses the trap of the rat race, where people work hard to earn money, only to be caught in a cycle of increasing expenses and debts.

The key lesson is understanding the difference between assets and liabilities. Kiyosaki argues that financial education, not just hard work, is crucial to escape this cycle. He shares his journey of learning how to invest and use money as a tool to build wealth, emphasizing the importance of mindset in achieving financial success.

Chapter 3: Why Teach Financial Literacy?

Kiyosaki critiques the lack of financial education in traditional schooling. He stresses that while academic and professional skills are important, they are often insufficient for wealth-building. He discusses the role of fear and ignorance in financial decision-making, emphasizing that financial literacy is crucial to navigate the complexities of the financial world and achieve independence.

The chapter highlights the importance of understanding different types of income (earned, portfolio, and passive) and the role of financial education in breaking the cycle of financial ignorance passed down through generations.

Chapter 4: Mind Your Own Business

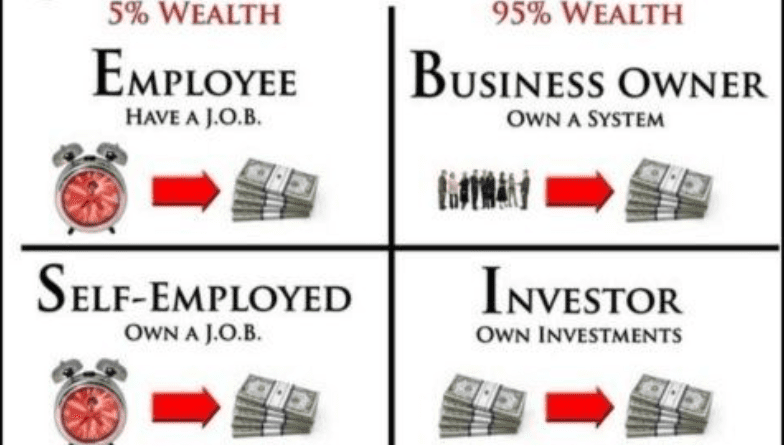

This chapter delves into the history of taxes and the benefits of owning a business. Kiyosaki explains how taxes impact individuals and how the rich use corporations to protect and enhance their wealth. He introduces the CASHFLOW Quadrant, a concept to categorize people based on their income source.

The chapter emphasizes the tax benefits and protections offered by corporations and encourages readers to shift from being an employee to becoming a business owner or investor. Kiyosaki argues that focusing on your own business is a key step in wealth-building, advocating for the acquisition of assets over simply earning a salary.

Chapter 6: The Rich Invent Money

Kiyosaki explores the concept of financial creativity and innovation. He emphasizes the importance of imagination in financial success, arguing that the rich use creativity to generate wealth. The chapter focuses on the difference between assets and liabilities and the significance of creating assets.

Kiyosaki shares stories illustrating how financial intelligence and creative thinking can lead to opportunities for wealth creation. He stresses the need for a proactive approach to investing and the importance of seeking new ways to generate income, breaking free from traditional financial constraints.

Chapter 6: Work to Learn—Don’t Work for Money

This chapter highlights the importance of working to learn, rather than just to earn money. Kiyosaki discusses the value of acquiring diverse skills and knowledge, especially in the areas of sales, marketing, and management.

He advocates for using employment as a learning opportunity to gain the skills necessary for entrepreneurship and investment. The chapter encourages readers to look beyond the immediate financial benefits of a job and focus on long-term educational benefits, preparing them for financial independence.

Chapter 8: Overcoming Obstacles

Kiyosaki addresses the common fears and obstacles that prevent people from achieving financial independence. He discusses the challenges associated with each of the four financial quadrants (Employee, Self-Employed, Business Owner, Investor) and offers advice on overcoming these challenges.

The chapter covers fears such as the fear of losing money and the desire for security. Kiyosaki emphasizes the importance of mindset, risk-taking, and stepping out of comfort zones in the pursuit of financial growth.

Chapter 8: Getting Started

This practical chapter provides guidance on beginning the journey towards financial independence. Kiyosaki emphasizes the importance of taking action, starting small, and learning from mistakes. He advises building a financial team, setting clear goals, and continuously educating oneself about finance and investment.

The chapter is a call to action for readers, stressing the need to actively manage and control their finances, and to seek opportunities for growth and investment.

Chapter 9: Still Want More? Here Are Some To Do’s

Kiyosaki concludes with actionable steps for readers to further their financial journey. He suggests making a conscious choice to pursue financial education, selecting friends who are financially knowledgeable, and learning from financial mentors.

The chapter includes practical advice like paying yourself first, focusing on asset building, and embracing the formula of “Learn, Earn, Return.” Kiyosaki emphasizes the importance of continuous learning, seeking professional advice, and maintaining a positive attitude towards financial opportunities and challenges.

Each chapter of “Rich Dad, Poor Dad” builds upon the previous ones, creating a comprehensive guide to changing one’s financial mindset and practices. The book is a blend of personal anecdotes, practical advice, and motivational encouragement, aimed at guiding readers towards financial independence and success.

Who Is This Book For (& Not)?

Ideal Readers of “Rich Dad, Poor Dad”

This book is particularly beneficial for individuals aiming for financial independence, aspiring entrepreneurs, and those interested in shifting away from a paycheck-to-paycheck lifestyle. It’s suited for readers new to financial planning and those who want to develop a foundational understanding of wealth building.

Who Might Not Benefit from This Book

“Rich Dad, Poor Dad” may not be as useful for individuals seeking detailed, step-by-step financial strategies or advanced investment advice. Additionally, those who are not open to rethinking their financial beliefs or are already well-versed in complex financial concepts might find the book less impactful.

What Can You Learn from “Rich Dad, Poor Dad”?

Understanding the Difference Between Assets and Liabilities

“Rich Dad, Poor Dad” emphasizes the fundamental financial concept of differentiating between assets and liabilities. The book teaches that assets put money in your pocket (like investments, real estate, or businesses), while liabilities take money out (such as loans and expenses). Kiyosaki’s narrative illustrates how prioritizing asset acquisition over liabilities is key to building wealth.

The Importance of Financial Education

Kiyosaki critiques the lack of financial literacy in traditional education and highlights the necessity of being financially educated. The book serves as a guide to understanding money management, investing, and the importance of financial intelligence. It encourages readers to seek knowledge beyond the conventional education system.

Shifting from Employee to Investor Mindset

The book encourages readers to shift their mindset from being an employee to becoming an investor or business owner. Kiyosaki argues that relying solely on a paycheck from a job (the employee mindset) limits financial growth. He suggests focusing instead on creating and acquiring income-generating assets.

The Role of Taxes and Corporations in Wealth Building

Kiyosaki delves into how understanding taxes and the use of corporate structures can play a significant role in wealth accumulation. The book explains how the rich minimize their tax burden and protect their assets through corporations, offering insights into sophisticated financial strategies.

The Power of Financial Creativity

“Rich Dad, Poor Dad” advocates for using creativity and innovative thinking in financial decision-making. Kiyosaki’s stories demonstrate how a creative approach to finance can lead to unique opportunities for income and wealth creation, challenging readers to think outside traditional financial norms.

Frequently Asked Questions (FAQs) About “Rich Dad, Poor Dad”

Can Following “Rich Dad, Poor Dad” Help Create Enormous Wealth?

While “Rich Dad, Poor Dad” provides foundational principles for wealth creation, it doesn’t guarantee enormous wealth. The book is a starting point, offering insights into how one might approach the process of wealth accumulation, but actual results depend on individual actions, market dynamics, and various external factors.

What Does Kiyosaki Mean by ‘Financial Genius’?

In “Rich Dad, Poor Dad,” Kiyosaki often refers to the concept of a ‘financial genius,’ which is essentially the ability to think creatively and intelligently about finances. This involves understanding and leveraging financial principles to maximize wealth-building opportunities.

How is Financial IQ Relevant According to “Rich Dad, Poor Dad”?

Kiyosaki emphasizes that increasing one’s Financial IQ is crucial for financial success. Financial IQ includes understanding money management, investment strategies, market behavior, legal knowledge, and tax benefits. The higher your Financial IQ, the better equipped you are to make sound financial decisions.

What Were the Core Beliefs of Rich Dad?

“Rich Dad” believed in financial education, investing in assets, and using money as a tool for wealth creation. He advocated for understanding the difference between assets and liabilities and encouraged entrepreneurial ventures as a path to financial independence.

What Role Do Income Statements Play in “Rich Dad, Poor Dad”?

Income statements are used in the book as a tool to understand and manage personal finances. Kiyosaki explains how to read and use income statements to differentiate between assets and liabilities. He emphasizes that a sound understanding of income statements is essential for effective financial planning and decision-making.

What is the Main Message of “Rich Dad, Poor Dad”?

The book emphasizes the importance of financial independence and education, advocating for a shift from traditional income-earning methods to generating wealth through assets. It underscores the need to understand how money works and the critical difference between assets and liabilities.

Is “Rich Dad, Poor Dad” Based on a True Story?

While presented as a memoir, the factual accuracy of Kiyosaki’s anecdotes has been debated. However, the book’s financial lessons and principles are widely regarded as valuable, regardless of the specifics of Kiyosaki’s personal history.

How Relevant is the Advice in “Rich Dad, Poor Dad” Today?

The core principles of financial independence and intelligence remain relevant today, but readers should adapt these concepts to current economic conditions and evolving markets.

How Does “Rich Dad, Poor Dad” Address the Financial Struggles of the Poor and Middle Class?

The book highlights the tendency of the poor and middle class to accumulate liabilities, not assets, leading to a cycle of financial struggle. Kiyosaki advocates for a mindset shift and increased financial literacy to break this cycle.

What Does Kiyosaki Mean by ‘Financial Genius’ and ‘Financial IQ’?

Kiyosaki uses ‘financial genius’ to describe the ability to think creatively about finances and ‘Financial IQ’ to refer to the knowledge of money management, investment, market behavior, legal aspects, and tax benefits. Both concepts are essential for maximizing wealth-building opportunities.

How Does the Book Differentiate Between What Rich People and Middle-Class People Acquire?

Kiyosaki notes that rich people focus on acquiring income-generating assets, while the middle class often acquire liabilities, mistaking them for assets. This difference in financial approach is a central theme of the book.

The summary is this – rich people acquire assets, middle class acquire liabilities. When one learns the difference, the change in path towards a richer life opens up.

Here’s some more career / job interview related help

- Tackling the final interview round

- How to answer ‘tell me about yourself’

- Interview questions for managers

- Do you need an Career coach / Interview coach?

- Career as a QA manager

- Project Management

- Managing Managers

- IT Career switch

- Software Engineering career path

Other posts that may interest you

- Careers– Agile Coach, RTE, Product Owner, Scrum Master

- Productivity

- Agility, Agile Testing

- Book summary apps – Headway App vs Blinkist vs getAbstract

- AI Writers: / Blogging – Jasper, Writesonic, Article Forge , Copy AI, Anyword, Writecream, Copymatic, Quillbot, Peppertype, Jasper AI (pricing) &

- Careers: Managing managers

- Work From Home tools: Jabra

About the author: Ilam’s career in Technology and Financial Services spans more than two decades, characterized by leadership roles and vast international experience. He has managed large global teams, worked across five countries, and engaged with colleagues from over 100 nationalities. Through this blog, Ilam shares his diverse experiences and insights, aiming to contribute to and enrich the community.