Is Major Banks A Good Career Path In 2024?

About the author: Ilam’s career in Technology and Financial Services (including some of the biggest banks in the world) spans more than two decades, characterized by leadership roles and vast international experience.

JP Morgan, Citibank, Morgan Stanley – Fancy names!! But is major banks a good career path in 2024? But before getting there, let’s take a minute to understand what they are.

Major banks are much more than traditional financial institutions. They are complex, multifaceted organizations where various career paths converge, from finance and technology to marketing and risk management (& so many more diverse paths).

Whether it’s the analytical rigor of investment banking, the strategic importance of a chief financial officer, or the innovative approaches in banking technology, the career possibilities in major banks are as varied as they are rewarding.

Our journey through this blog will provide insights into the different aspects of working in major banks. We’ll delve into various roles, from front-line bank tellers to high-level financial analysts, and explore how these positions contribute to the broader financial industry.

Here’s some helpful career/leadership related blogs

- Is Major Banks A Good Career Path In 2024?

- Is Business Services A Good Career Path In 2024?

- Is Commercial Banks A Good Career Path In 2024?

- Do you need an Career coach / Interview coach?

- Careers– Agile Coach, RTE, Product Owner, Scrum Master, QA Manager

- Career development plan

- Career growth

- Project Management

- Managing Managers

- IT Career switch

- Software Engineering career path

- Agility, Agile Testing

- Remote leadership / Leadership traits / Agile leadership

The Diverse World of Major Bank Careers

Major banks are not just centers for financial transactions; they are hubs of diverse and dynamic career opportunities. This section delves into the various roles that major banks offer, illustrating the breadth and depth of careers beyond traditional banking.

Investment Banking: The High-Stakes Game

Investment banking is a prominent segment within major banks known for its high stakes and high rewards. Investment banks play a crucial role in financial markets, engaging in activities like mergers and acquisitions, underwriting, and portfolio management.

They serve as vital connectors between investors and those seeking capital, making pivotal decisions that influence the market.

Retail Banking: The Face of Personal Finance

In retail banking, professionals are on the front line, directly interacting with customers. These roles include bank tellers, loan officers, and customer service representatives. Here, professionals manage everyday banking services, help customers with loan payments, and advise on savings accounts.

It’s a sector that highly values customer service skills and a deep understanding of financial products.

Technology and Innovation: Banking’s Digital Frontier

The rise of fintech has transformed the banking industry, creating a surge in tech-centric roles. These include positions in cybersecurity, data analysis, digital product development, and IT management.

Professionals in this field work on the cutting edge of financial technology, ensuring that banks stay ahead in a rapidly evolving digital landscape.

Corporate and Investment Banking: Behind the Scenes

This sector (sometime known as commercial banking) involves roles in financial analysis, risk management, and corporate finance. Financial analysts and managers here deal with complex financial statements, oversee cash flow, and provide insights for investment opportunities.

They are the backbone of a bank’s financial health, offering strategic guidance and risk assessment.

Support Functions: The Unsung Heroes

Major banks also house various support functions such as human resources, legal services, marketing, and administrative roles. These professionals ensure the smooth operation of the bank, managing everything from financial records to regulatory compliance.

This overview of the diverse career paths in major banks underscores the vast array of opportunities available. Each role, whether directly related to banking or in a support function, contributes significantly to the overall success and operation of the financial institution.

Skills and Qualifications: The Building Blocks for a Career in Major Banks

Navigating a career in major banks requires a unique set of skills and qualifications. This section explores the essential competencies and educational requirements that can pave the way for a successful career in the diverse landscape of major banking.

Educational Foundation

Most positions in major banks require at least a bachelor’s degree, typically in fields like business administration, finance, economics, or accounting. For more specialized roles, such as investment bankers or financial analysts, additional qualifications or certifications, like a Chartered Financial Analyst (CFA) designation or a Master’s in Business Administration (MBA), can be highly advantageous.

Essential Skills for Banking Professionals

- Analytical Abilities: Crucial for roles in investment banking and financial analysis, strong analytical skills help in assessing financial markets, understanding financial statements, and making data-driven decisions.

- Technical Proficiency: Especially relevant in technology and operations roles, a deep understanding of digital tools, cybersecurity, and financial software is key.

- Customer Service Skills: Vital in retail banking and customer-facing positions, these skills include communication, problem-solving, and the ability to handle customer inquiries effectively.

- Attention to Detail: Essential for managing financial records, compliance, and legal matters, ensuring accuracy and adherence to regulations.

Regulatory Knowledge and Certifications

A comprehensive understanding of the financial industry’s regulatory environment is crucial. Certifications from bodies like the Financial Industry Regulatory Authority (FINRA) may be required for certain roles. Additionally, staying abreast of changes in financial laws and regulations is important for professionals in all areas of banking.

Soft Skills: The Underrated Arsenal

Soft skills such as leadership, teamwork, adaptability, and ethical judgment are increasingly valued in the banking sector. These skills facilitate effective collaboration, decision-making, and can often be the differentiating factor in career advancement.

This blend of educational background, hard skills, and soft skills forms the foundation for a thriving career in major banks. The right combination of these elements not only helps in securing a position but also paves the way for long-term career growth and success in the ever-evolving world of banking.

Career Growth and Advancement: Climbing the Ladder in Major Banks

A career in major banks is not just about landing a job; it’s about growth, development, and advancement. In this section, we explore the pathways for career progression and how professionals can elevate their careers within the dynamic environment of major banks.

Entry-Level to Executive: Mapping the Journey

Starting a career in banking often begins with entry-level positions such as bank tellers, junior analysts, or assistant roles in various departments. These roles provide a foundation for understanding the basics of banking operations, financial services, and customer interaction. From there, employees can advance to managerial positions, overseeing teams, departments, or specific financial functions.

Professional Development Opportunities

Major banks invest heavily in the training and development of their staff. This includes internal training programs, mentorship initiatives, and opportunities for further education and certifications. Employees are encouraged to continuously upgrade their skills and knowledge, staying relevant in a rapidly changing financial landscape.

Specialization and Diversification

As one progresses, there’s an opportunity to specialize in areas like investment management, corporate finance, or risk assessment. Alternatively, some professionals choose to diversify their experience by rotating through different departments or functions within the bank, gaining a well-rounded perspective of the banking operations.

Leadership and Strategic Roles

For those aspiring to reach the top echelons, roles such as a chief financial officer, senior portfolio manager, or head of corporate banking become attainable. These positions require a combination of deep industry knowledge, strategic thinking, and strong leadership abilities. They involve making critical decisions that shape the bank’s future and influence the broader financial market.

Networking and Industry Involvement

Building a robust professional network and staying actively involved in the banking community can also play a significant role in career advancement. Attending industry conferences, participating in professional associations, and networking with peers can open doors to new opportunities and insights.

In major banks, the career ladder is not just vertical but multidimensional. With the right mix of skills, experience, and continuous learning, professionals in the banking sector can navigate a rich and rewarding career path, filled with diverse opportunities for growth and advancement.

The Financial Rewards and Challenges: Balancing the Scales in Banking Careers

| Pros of Banking Careers | Cons of Banking Careers |

|---|---|

| Competitive Salaries – Offers competitive salaries, especially in fields like investment banking, asset management, and corporate finance. | High-Pressure Environment – Can be stressful due to tight deadlines, demanding targets, and significant financial responsibilities. |

| Performance Bonuses and Incentives– Many positions include performance-related bonuses, potentially leading to significant additional financial rewards. | Long Working Hours – Especially in early career stages, impacting work-life balance. |

| Advancement Opportunities – Provides clear career progression paths, leading to higher earnings and influential roles. | Economic Sensitivity – Sensitive to economic downturns, with market fluctuations affecting job security and stress levels. |

| Comprehensive Benefits – Major banks often offer extensive benefits, including health insurance, retirement plans, and wellness programs. | Rapid Industry Changes – The fast pace of change in financial products, regulations, and technology requires continuous learning and adaptation. |

Working in major banks can be both rewarding and challenging. This section explores the balance between the financial incentives and the demands of a career in banking, outlining four key advantages and four potential drawbacks.

Pros of Banking Careers

- Competitive Salaries: One of the most significant advantages is the competitive salaries offered in the banking sector, especially in roles like investment banking, asset management, and corporate finance.

- Performance Bonuses and Incentives: Many banking positions include performance-related bonuses, providing the potential for significant financial rewards above base salaries.

- Advancement Opportunities: The banking sector offers clear paths for career progression, which can lead to higher earning potential and more senior, influential roles.

- Comprehensive Benefits: Besides monetary compensation, major banks often provide extensive benefits packages, including health insurance, retirement plans, and employee wellness programs.

Cons of Banking Careers

- High-Pressure Environment: Banking jobs, particularly in fields like investment banking and financial markets, can involve high stress due to tight deadlines, demanding targets, and significant financial responsibilities.

- Long Working Hours: Many positions, especially in the early stages of a career, require long hours, which can impact work-life balance.

- Economic Sensitivity: While the banking sector is stable, it is also sensitive to economic downturns. Market fluctuations can affect job security and stress levels in roles tied closely to financial markets.

- Rapid Industry Changes: The fast pace of change in financial products, regulations, and technology requires continuous learning and adaptation, which can be challenging for some professionals.

A career in major banks offers a blend of financial rewards and professional challenges. While the financial incentives and career growth opportunities are significant, they come with a set of demands that require resilience, adaptability, and a commitment to continuous professional development.

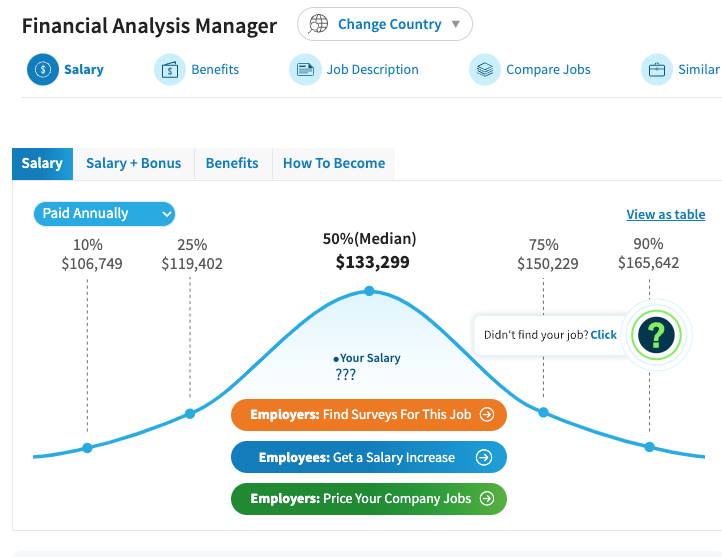

Best Paying Jobs in Major Banks: Roles Across the Spectrum

Major banks offer a wide array of career opportunities, with positions ranging from entry-level to senior executive roles across various departments. Here’s a more comprehensive list of roles at different career stages, along with key responsibilities, required skills, and typical salary ranges. The ranges vary widely based on the banks, location, experience levels etc.,

Entry-Level Positions

- Bank Teller

- Responsibilities: Handling customer transactions, cash management, basic account services.

- Skills: Customer service, attention to detail, basic math.

- Average Salary: $25,000 – $35,000 per year.

- Junior Financial Analyst

- Responsibilities: Assisting in financial reporting, data analysis, budgeting.

- Skills: Analytical thinking, proficiency in Excel, basic financial modeling.

- Average Salary: $50,000 – $60,000 per year.

- Credit Analyst

- Responsibilities: Assessing creditworthiness of clients, analyzing financial statements.

- Skills: Risk analysis, financial reporting knowledge, detail-oriented.

- Average Salary: $40,000 – $60,000 per year.

- Retail Banking Officer

- Responsibilities: Managing customer accounts, advising on retail banking products.

- Skills: Sales skills, customer relationship management, financial product knowledge.

- Average Salary: $35,000 – $50,000 per year.

Mid-Level Positions

- Loan Officer

- Responsibilities: Evaluating loan applications, advising on loan options, managing credit portfolios.

- Skills: Financial analysis, customer service, decision-making.

- Average Salary: $60,000 – $80,000 per year.

- Compliance Officer

- Responsibilities: Ensuring the bank adheres to laws and regulations, risk management.

- Skills: Regulatory knowledge, attention to detail, ethical judgment.

- Average Salary: $70,000 – $100,000 per year.

- Relationship Manager

- Responsibilities: Building and maintaining client relationships, understanding client needs, offering tailored banking solutions.

- Skills: Strong interpersonal skills, customer-focused approach, deep understanding of banking services.

- Average Salary: $65,000 – $85,000 per year.

- IT Analyst in Banking

- Responsibilities: Implementing and maintaining banking technology solutions, data security.

- Skills: Technical proficiency, problem-solving, knowledge of banking software and systems.

- Average Salary: $70,000 – $90,000 per year.

- Marketing Manager

- Responsibilities: Developing and executing marketing strategies, brand management, customer engagement.

- Skills: Strategic thinking, creativity, expertise in digital marketing.

- Average Salary: $75,000 – $95,000 per year.

Senior-Level Positions

- Investment Banker

- Responsibilities: Advising on M&A, managing large financial transactions, investment strategies.

- Skills: Advanced financial knowledge, strategic thinking, negotiation skills.

- Average Salary: $100,000 – $150,000 per year, with potential for substantial bonuses.

- Chief Financial Officer (CFO)

- Responsibilities: Overseeing financial operations, strategic planning, financial reporting.

- Skills: Leadership, financial expertise, strategic management.

- Average Salary: $150,000 – $250,000+ per year, varying with bank size and experience.

- Risk Management Director

- Responsibilities: Identifying and mitigating financial risks, developing risk management strategies.

- Skills: Risk assessment, strategic planning, regulatory knowledge.

- Average Salary: $120,000 – $180,000 per year.

- Portfolio Manager

- Responsibilities: Managing investment portfolios, developing investment strategies, client interaction.

- Skills: Investment expertise, analytical skills, client relationship management.

- Average Salary: $90,000 – $140,000 per year.

- Director of Operations

- Responsibilities: Overseeing the bank’s operational aspects, process optimization, efficiency enhancement.

- Skills: Operational management, leadership, process improvement.

- Average Salary: $130,000 – $180,000 per year.

These roles in major banks illustrate the range of opportunities available, each requiring specific skills and offering different salary ranges. Salaries can vary based on location, the size of the bank, and individual qualifications.

Additionally, many senior roles include performance bonuses, stock options, and other benefits, enhancing the overall compensation package. The banking industry, with its diverse range of roles, presents a pathway for professional growth and financial success.

Top Major banks in the world

This is a dyanamic list and subject to change based on the banks’ performance and global economic conditions. For specific and up-to-date statistics such as assets, revenue, market capitalization, and employee count, you should refer to each bank’s official annual report or reliable financial news sources.

- JPMorgan Chase & Co.: Largest bank in the United States by assets.

- Industrial and Commercial Bank of China (ICBC): Known as the largest bank in the world by total assets.

- Bank of America: One of the big four banking institutions in the U.S.

- Wells Fargo: A leading bank in terms of home mortgage servicing.

- China Construction Bank: Second-largest bank in the world by market capitalization.

- HSBC Holdings PLC: One of the world’s largest banking and financial services organizations, headquartered in London.

- Agricultural Bank of China: One of the “Big Four” banks in China, serving a large rural community.

- Citigroup Inc.: Multinational investment bank with a significant global presence.

- Bank of China: One of China’s most international banks, with branches on every inhabited continent.

- Mitsubishi UFJ Financial Group: Japan’s largest financial group and the world’s second-largest bank holding company.

- Goldman Sachs Group: A leading global investment banking, securities, and investment management firm.

- Morgan Stanley: Known for its wealth management services and investment banking.

- BNP Paribas: The largest French banking group and a prominent international banking institution.

- Barclays PLC: A British multinational investment bank and financial services company.

- Royal Bank of Canada: The largest bank in Canada by market capitalization.

- Banco Santander: One of the biggest banks in Europe, based in Spain.

- Toronto-Dominion Bank: Known as TD Bank, one of the largest banks in Canada.

- UBS Group AG: A Swiss multinational investment bank and financial services company.

- Sumitomo Mitsui Financial Group: One of the main Japanese financial services groups.

- Deutsche Bank AG: A leading global investment bank based in Germany.

Additional Sources

- Bureau of Labor Statistics (BLS): Provides comprehensive data on employment and wages across various sectors, including consumer services. Visit BLS

- LinkedIn Salary Insights: Offers detailed salary information based on job title and location, sourced from LinkedIn’s user data. Check LinkedIn

- Glassdoor: A platform where employees and former employees anonymously review companies and their management, and provide insights into salaries and job responsibilities. Explore Glassdoor

- Indeed: Features job listings as well as salary data and company reviews provided by employees. Visit Indeed

Other Productivity / Tools posts that may interest you